Why are my cardboard box orders taking longer? Here’s why.

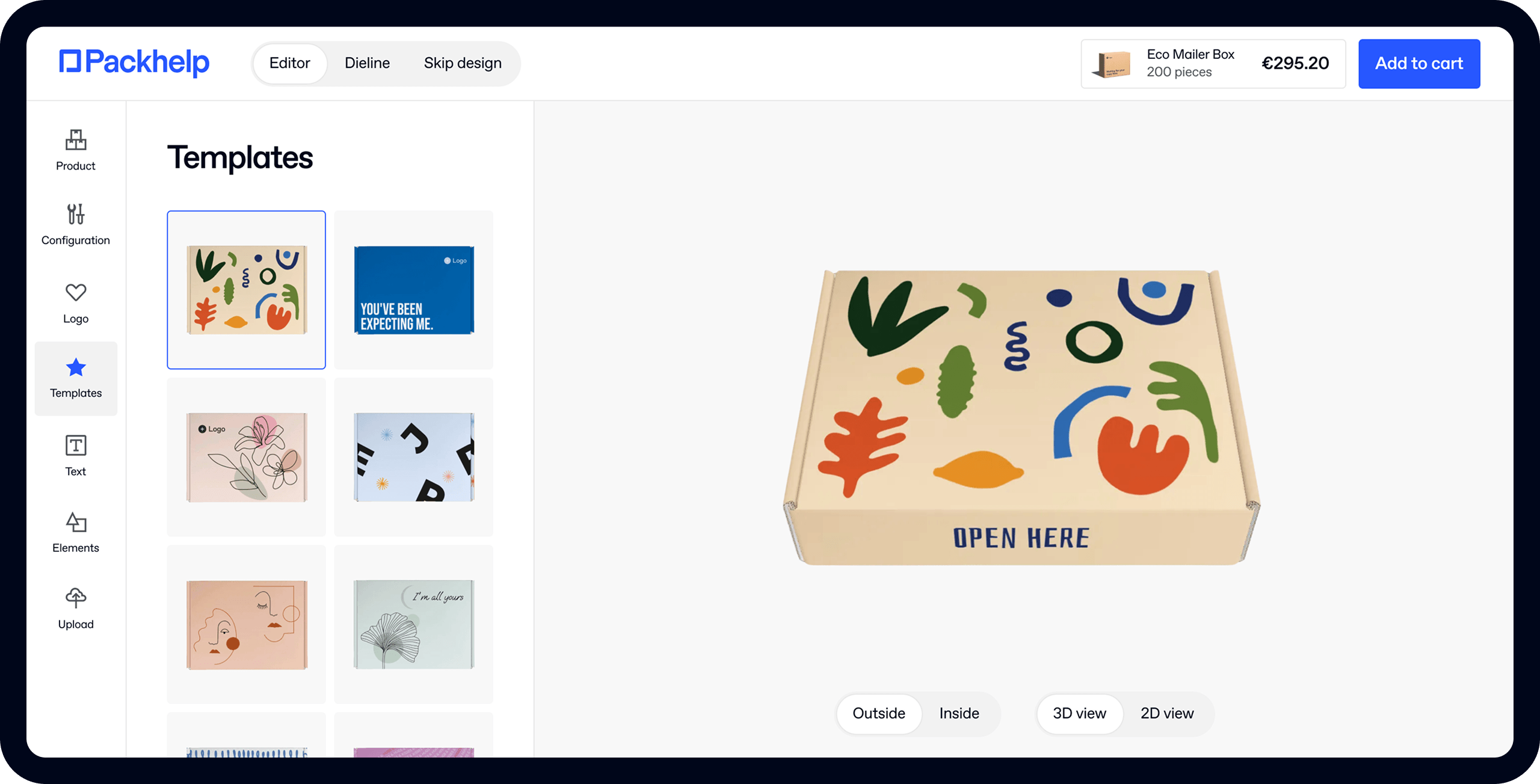

- 200+ templates & patterns

- Real time 3D packaging preview

- Upload logo and choose brand colours

Subscribe now! Receive 15% discount.

Don’t miss out – get 15% off your first order when you join the newsletter. It’s fast, free, and kinda smart.

You're now subscribed!

In this article:

Where are my boxes?

It’s been a question on everyone’s lips since the beginning of the year. From e-commerce merchants and brick-and-mortar retailers to packaging suppliers, we’ve all asked that question at one stage along the supply chain.

And it’s not just in Europe or the UK. This same question has been repeated across the world.

In the meantime, our inventory of mailing and shipping boxes is dwindling and packaging production lead times are growing. And yet customer orders continue to flood in after a bumper festive season.

The frustration is palpable. Something has to give. And fast.

In this explainer article, you’ll find some answers to the questions:

⇒ What is the scope of the supply chain issue?

⇒ What are the potential causes of the problem?

⇒ What has the industry been doing to fix the problem?

⇒ And finally, when can you get your boxes back?

⇒ Bonus tips: How to streamline the packaging ordering process.

In a nutshell

Here’s the strange thing. The corrugated cardboard producers themselves have been asking the same question: where are my boxes.

Why?

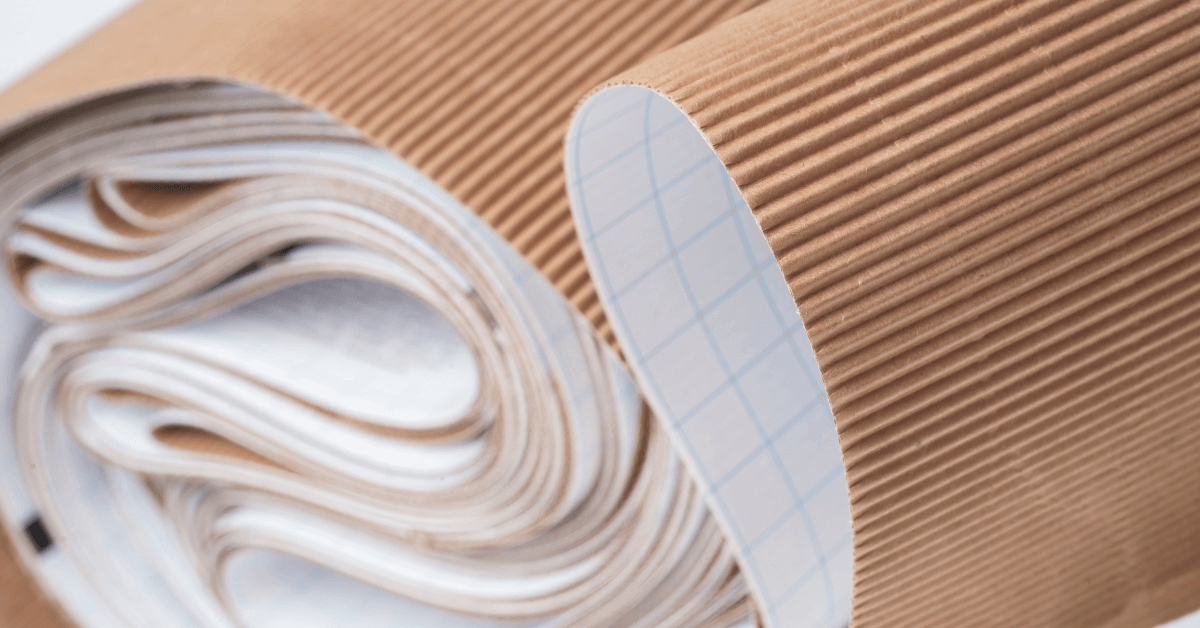

The majority of cardboard packaging is made, on average, from 80% recycled content.

This means that cardboard producers are heavily dependent on a steady flow of used packaging reaching recycling plants.

It turns out that this usual flow has dried up. And without the recycled pulp, producers are struggling to keep up with demand.

“The industry right now is a little perplexed,” says Artur Oboleński, Head of Packhelp Lab. “This is not just one market or Europe. It’s happening in the USA, Asia. It’s rare to see the whole world affected by the same supply chain issues at the same time.”

With 20+ years in the game, Oboleński has witnessed his fair share of supply chain fluctuations. But this one is different. Like other industry insiders, he describes it as the perfect storm of interconnected factors.

There are the usual culprits of COVID, Brexit and big e-commerce (cough, Amazon) causing havoc to the supply chain.

There are the superheroes of e-commerce recording unprecedented growth and pushing up demand for packaging.

And there are a few surprises thrown in. For example, could our success at transitioning to sustainable packaging play a role? (More on that later)

All these elements have layered on top of each other to produce one mother of all bottlenecks.

We’ve decided to do some exploring and unpack this issue to see if we can find some answers for you – and hopefully shed some light on when you might be able to get your hands on your boxes.

What is the scope of the problem?

Before we dive into the why, let’s see what we’re really up against.

First up, it’s a global problem. From Europe and North America to India, corrugated cardboard producers have reported insane demand volumes over the past year.

In the US, corrugated cardboard shipments exploded in March 2020 to grow by 9% YoY, according to the Fibre Box Association. This growth continued through the summer and into the festive season, resulting in 3.4% YoY growth for 2020.

DS Smith, the UK’s largest cardboard box manufacturer, reported that demand grew by 3% YoY between May and October last year before increasing to 6% in November.

In India, the supply of kraft paper used in corrugated boxes reduced by 50% last year. It is estimated that this pushed up the cost of manufacturing by 60%.

And what about Europe?

“Our packaging is produced almost exclusively in Europe,” says Oboleński. “In terms of our operation, around 5-8% of cardboard orders have been affected with delays. While we have observed issues with greyboard, it’s mainly corrugated cardboard that concerns us.”

This supply shortage has been pushed upstream to affect the production of mailer boxes, delivery boxes, shipping boxes and other corrugated cardboard boxes.

The mix of demand and supply-side pressures has naturally pushed up prices. The US industry began to pass on a $50-per-ton price hike on corrugated cardboard shipments in November.

In Europe, the local industry has reacted slightly differently.

“For us, our own input costs have increased by around 8-10%,” says Michał Kłosiński, Custom Production Team Leader at Packhelp. “We have tried to absorb the extra costs as much as possible. So, at this stage, we have managed to limit the price increase on our affected products to around 5%. It’s not ideal for our customers. But it could be worse.”

What are the potential causes of the supply chain problems?

Like most things in 2020, the cardboard supply chain issues began with the COVID-19 pandemic.

But depending on where you’re sitting, COVID-19 produced both positive and negative outcomes.

A retail bonanza in two acts

Brick-and-mortar retail first boomed as consumers hit the stores in a panic buying frenzy.

The e-commerce sector then saw a surge in demand as we were forced into lockdown and moved our purchases online.

E-commerce sales in the US came in at an estimated $861.12 billion in 2020, which represented a crazy YoY growth rate of 44%. Amazon alone claimed about a third of that growth.

The UK and European markets are expected to report similar figures.

What’s more, the usual online shopping rush around November and December seemed to spill over into the new year.

Double squeeze on the supply chain

The effect of these two waves on the cardboard supply chain worked in two ways. The first brick-and-mortar wave saw a huge rise in B2B deliveries.

Manufacturers, wholesalers and logistics companies went into overdrive to supply supermarkets, DIY stores and other retail outlets with stock. This caused demand for shipping boxes to spike.

The next e-commerce boom led to our logistics networks being clogged up with billions of smaller individual packaging units. The 20 kg shipping boxes were swapped for mailing boxes.

The Recycling Association in the UK calculated that an extra 200 million home deliveries took place in the UK during the holiday season.

Meanwhile, Amazon delivered a record 1.5 billion packages worldwide in the same period.

And where does Amazon fit in?

It has been reported widely that Amazon and other e-commerce giants began to stockpile packaging supplies at the end of last year.

At around the same time, UK retailers squirrelled away tons of cardboard packaging before the January 1 Brexit deadline.

But what do these two waves have in common? The packaging used to deliver the goods was all mainly made out of the same material: corrugated cardboard fabricated from a large proportion of recycled pulp.

And here’s the cork to this bottleneck.

The sudden swing from bricks-and-mortar to online retail caused unprecedented disruption to the cardboard recycling ecosystem.

Sustainability: have we become a victim of our own success?

In 2019 BC (Before Covid), the large cardboard recycling plants and cardboard producers could rely on a steady source of shipping boxes being returned directly from retailers and wholesalers.

The game changed when this legacy retail channel closed and e-commerce took over.

Compared to the bulk shipping model, e-commerce sales are individual in nature and orders are delivered in smaller pieces of packaging.

In the e-commerce world, each unit of recyclable packaging tends to remain out of circulation for a far greater time.

To some extent, this fact can be accounted for by our push towards sustainable packaging solutions and factoring in reusability into packaging.

The returnable delivery box is one such example. Unwanted goods are often returned in their original packaging and in turn, e-commerce merchants ship back the replacements in sometimes the same box.

Ultimately, that doubles the amount of time that it takes for the cardboard packaging to reach the recycling plant.

Packaging has also become more durable and designed with features to encourage customers to repurpose the boxes for other uses.

But in reality, a big proportion of these boxes simply lay around households gathering dust and thus remain out of the recycling ecosystem.

Adding to this, the packaging industry has taken up the call for sustainability with gusto over the years. The amount of recycled content in corrugated cardboard has increased considerably.

For example, Packhelp’s mailing and shipping boxes are made from 90% recycled content. The other 10% comes from virgin wood pulp sourced from responsibly managed forests and mills.

This begs the question of whether we have become a victim of our own success in our sustainability missions?

Whatever the answer to that question, one thing is clear: the way we use cardboard packaging changed almost overnight and our recycling infrastructure was simply not built for such a rapid change.

How has the packaging industry been dealing with the situation?

All along the supply chain, the industry as a whole has worked overtime to supply orders and keep lead times to a minimum. That starts with the recycling plants and moves to the packaging producers, suppliers and retailers.

“We understand the frustration out there and we know how high the stakes are,” says Adam Flasiński, Head of Account Management at Packhelp. “My team has been working around the clock to come up with solutions for our customers to limit the wait. Our Supply Chain team has searched for alternative producers across Europe. And as a company, we have tried to absorb the price increases as much as we can.”

With that said, Flasiński admits that the prices on products like mailers and shipping boxes have increased by around 5% on average.

At the end of the day, as Oboleński points out, packaging suppliers like Packhelp can’t control the supply of raw materials and their prices.

“There’s no amount of money that you can throw at the problem to fix it,’ says Oboleński. “The raw materials are just not available.”

So, when can I get my boxes?

In recent months, more positive signs have come out of Europe’s paper and board industry.

Polish producers, some of the biggest in the EU, have reported that they came through the second COVID-19 wave in November in better shape than originally feared.

They had learnt from the first lockdown in March and implemented changes to their production line. This meant that they could continue operation despite the government imposed lockdown.

Others used the downtime to invest in infrastructure to ramp up production.

The big UK producers are also more optimistic now that the disruptions from Brexit and the pandemic have begun to die down.

The UK’s success in the vaccination rollout bodes well for high-street retail. As the economy opens up, the traditional retail channels should build momentum and restore some equilibrium to the recycling ecosystem.

In the meantime, Flasiński has provided a few tips to minimize the lead times of your orders.

Tips: How to streamline the packaging ordering process

- Order earlier than usual. In this current environment, you never know when the next online sales rush will hit. This way you will be better prepared for the spike in demand and increase your chances of receiving your packaging on time.

- Reach out to your account manager and see if they can find you an optimised solution. This could mean another type of packaging or a custom solution using less materials. Chances are, you’ll be able to find savings in the process.

- Consider moving to a long term contract. You can add more certainty to your packaging supply chain and lock in a price with a long-term contract. Plus, you can save with bulk discounts.

- Raise awareness among your customers about recycling. More recycling not only supports your sustainability mission, but as we’ve seen, it can improve the supply of corrugated cardboard and keep prices down.

Get in touch

Have any questions about your packaging orders? Reach out and our sales team will be more than happy to answer any of your questions.

→ Get in contact

→ Help & FAQ