The Global Supply Chain Disruption & Your Packaging

- 200+ templates & patterns

- Real time 3D packaging preview

- Upload logo and choose brand colours

Subscribe now! Receive 15% discount.

Don’t miss out – get 15% off your first order when you join the newsletter. It’s fast, free, and kinda smart.

You're now subscribed!

In this article:

- A global workforce shortage is putting added pressure on post-lockdown supply chains

- Manufacturers and distributors can't keep up with demand

- The growth of e-commerce has increased the demand and need for cardboard

The northern area of France is known for some superb things. Many war memorials dot the landscape, and the regional capital of Lille is an eclectic mix of gothic and art-deco architecture. On a clear day, you can even see the white cliffs of Dover from several beaches around Cap Gris Nez.

But today, the Hauts-de-France region isn't a particularly nice place to pass through.

Queues for trucks to board a train through the Chunnel stretch back for kilometres. Police and security guards patrol rest areas set up by truck drivers as they wait several hours to move a few dozen meters.

The scenario described is not new.

The reality is that the effects of the pandemic are still felt on the economy two years later, effects that are now being exacerbated by Brexit, labour shortage and the UK's high vaccination rate.

The EU/UK Supply Chain Disruption

The pandemic has closed the doors of a record number of physical and online stores.

According to CoStar Group, in January 2021, a record 12,200 businesses had gone bankrupt since the beginning of the pandemic some 12 months earlier.

With the relaxation of restrictions due to the vaccine, the demand for goods has increased significantly.

Consumers have returned in force, eager to shop, and businesses that received real blows during the pandemic have begun to recover.

But purchasing power is no longer the same.

The shopping is back, but there's nothing there to buy.

With lockdowns lifted, demand has rocketed. And supply chains that were disrupted during lockdown are struggling to bounce back.

This brings us back to the situation in the north of France. Trucks lining up to deliver products made in the EU to supply British demand:

Power tools from Czechia, Estonian electronics, white goods from Poland, Italian clothing.

Below, Sainsbury store shelves in London sits almost void of fruit and vegetables.

Image Source: Hollie Adams/Bloomberg

To be clear, the food is there - it just can't get where it's needed.

But manufactured goods are another story.

The reasons are varied, from the lack of labour and raw materials to new regulations and tariffs on EU products being imported to the UK and, of course, the general increase of prices.

Manufacturing Shortages

Energy crises in China and Europe have affected massive production in the last half-year, localised cases of Coronavirus infection have led to the blocking of goods in ports in the States, to which is added the lack of trucks and natural disasters.

A computer chip shortage is only slowing down the pace even further.

Image source: Kyle Grillot/Bloomberg

"Border controls and mobility restrictions, the unavailability of a global vaccine permit and declining demand due to blockages have combined for a perfect storm in which global production will be hampered because deliveries are not made on time, costs and prices they will grow," explains Tim Uy of Moody’s Analytics.

This perverted supply chain forces those that can afford it to place precautionary orders to avoid running out of goods, which only compounds pressure.

At present, supply is a setback, mainly due to blockages in each link in the supply chain.

The last quarter of the year is expected to be difficult, and those purchasing at the last minute will pay a premium and undoubtedly face delays.

The American Situation

The US is fairing no better than the EU and UK.

Below, cargo trucks are parked at the Port of Los Angeles on Wednesday, October 13, 2021.

Offshore, a record number of cargo ships are anchored, waiting for a free place to dock and unload.

Several years ago, a shipping container would wait at the Port of L.A. for an average of 5 hours before being moved on. That average is now three weeks.

A shortage of labour in truck drivers and warehouse staff is at the heart of the problem.

Truck drivers are overworked and overwhelmed, having to confront logjams that take hours to get through.

Advocates say that investment in rail structure would take thousands of trucks off Southern California's already strained road and make moving heavy, expensive farming goods to America's food belt much more efficient.

Some firms have gone as far as to get executives out of the office and onto the floor, working the most in-demand jobs after basic training.

Overpriced Cardboard

While manufacturing is becoming more costly, so is one of the most relied upon materials in just about every supply chain - paper pulp.

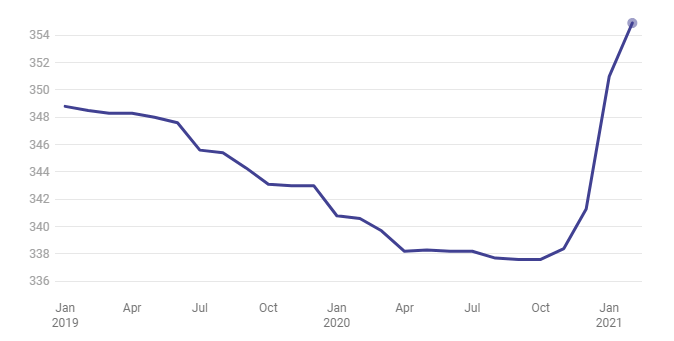

Packaging ranked fourth in product types by sourcing volume for Q3 21'. The demand for corrugated boxes has increased QoQ by 358%.

This trend is reflected in the cost of cardboard:

The Institute for Supply Management's manufacturing report explains cardboard boxes have been listed as a commodity that's in a global supply shortage, with prices rising for the last 5 months.

Wood container and pallet manufacturing have also seen record growth, putting more demand on an arguably renewable resource, wood. Pallet costs were up 400% in May 2021.

The meteoric growth of e-commerce has contributed to the demand for cardboard packaging and, therefore, its shortage.

As concern about rising demand has grown, giants like Amazon have been stockpiling cardboard since January, leaving smaller businesses empty-handed.

This has created a real monopoly, the most affected being the companies that purchase their raw materials and packaging from China and the USA.

The Looming Holiday Season

The last quarter of 2021 is expected to be the most challenging time.

An already overstressed and fragile supply chain will have to carry the weight of the holiday season.

Retailers and wholesalers who decide to stock their shelves at the last minute will be forced to pay more and wait longer.

Couriers like UPS and FedEx, and national post services like Royal Mail and Australia Post are already experiencing severe delays as they try to catch up.

Small e-commerce brands now face another hurdle - how do they get their orders to customers on time?

Despite the global crisis, Packhelp customers can breathe a sigh of relief this quarter.

We've created several handy resources to make sure you get your packaging on time and at a price you're happy with.

Take a look at our high-season packaging calculator and figure out exactly when you need to place your order to get it in time.

Simply pick the product you need and the date you need it. You'll be presented with several production and delivery options to ensure you get your packaging when you need it.

We've also created a guide to Q4, explaining how your brand can leverage popular holidays to boost sales and interviewed over 20 experts who share their Q4 marketing ideas.

Don't Put Off Ordering

Supply chain analysts agree that things will only get worse before they get better.

Packhelp encourages you to place your order as soon as possible, no matter how big or small that order may be.

Take a look at Packhelp's range of packaging and place your order sooner rather than later.