What The Ecommerce World Learned From A Tough 2021 [Stats]

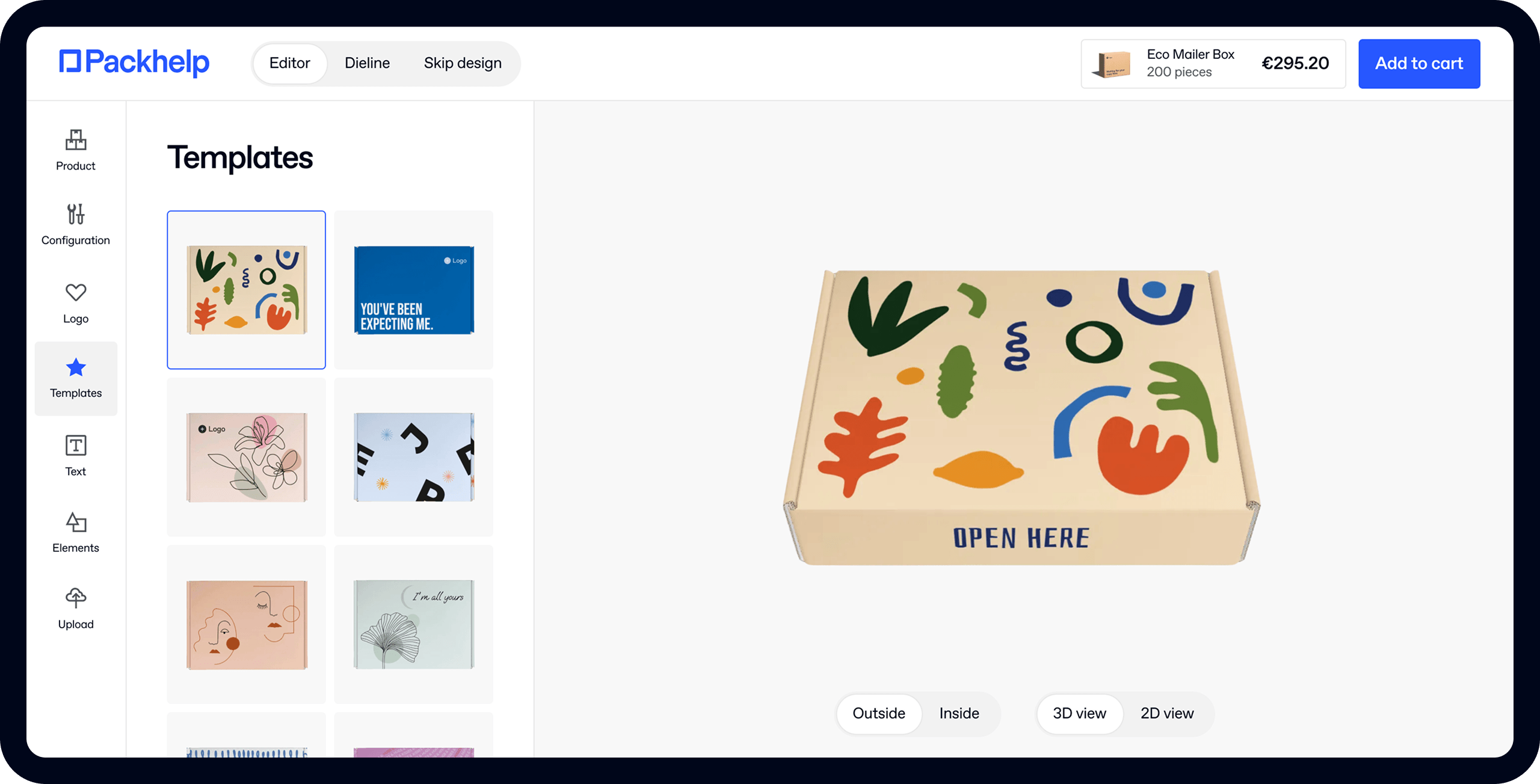

- 200+ templates & patterns

- Real time 3D packaging preview

- Upload logo and choose brand colours

Subscribe now! Receive 15% discount.

Don’t miss out – get 15% off your first order when you join the newsletter. It’s fast, free, and kinda smart.

You're now subscribed!

In this article:

- The timeline

- Supply chain crunch

- Staying local avoids the crunch.

- More on the supply chain:

- Diversification as a solution

- Customers stock up on FMCG.

- Inventories are beefed up.

- The resilience of the ecommerce business model

- And the resourcefulness of ecommerce business owners.

- The role of the customer increases

- People

- Conclusion

The start of 2021 was plagued by the uncertainty of the year ahead for digital and physical retail.

It was a character-building year, marred with supply chain struggles, new COVID variants and a shift to some unknown form of ‘normal’.

We surveyed retailers in these spaces, and this article looks at what retailers learned from operating in the economy and environment that was 2021.

We went and spoke with Packhelp customers, as well as other ecommerce, D2C, subscription box companies and retail stores, and explored their operations and findings from 2021.

As a supplier to the brands mentioned above and an ecommerce company ourselves, we’ve also spoken to the heads of specific departments at Packhelp and got them to share what they’ve learned as well.

The timeline

As early as February 2021, vaccines in North America, Europe and the EU had just started to roll out on mass, and retailers had their sights set on some kind of normality.

The ecommerce industry, which saw unprecedented growth in 2020, was going to face a new challenge as consumers ‘returned to normality’.

Would this ‘normality’ be a shift in returning to traditional retail, or were consumers happy to do most of their shopping online indefinitely?

According to a survey in February 2021, 56% of respondents in Canada said they were planning to shop more in-store, but only one in three were planning to shop less online.

Consumers wanted to go out and spend, and online shopping was set to face a struggle.

In the springtime of 2021, Forbes reported that over 70% of the 1,000+ consumers surveyed mentioned their community starting to emerge from the crisis.

Then in early summer, the delta variant started to spread. The Delta strain meant retailers had to reinforce social distancing and other in-store regulations to stay open.

At face value, one would think the new wave of restrictions would force consumers to stay home and shop online.

But the opposite was true.

Even with these new restrictions, the US National Retail Federation reported that September sales were up 14.5% compared to the year before.

But whether brick and mortar or ecommerce, the consumer’s preferred medium wasn’t the only challenge to face.

Supply chain crunch

A blockage in the Suez canal, a shortage of truck drivers in the US and a global labour shortage in docks and shipyards froze an already weary supply chain.

Packhelp was one company that felt this supply chain shortage.

A global paper pulp shortage meant that factories couldn't produce cardboard, toilet paper, and labels at the rate they once were.

Our customers, both retail and ecommerce, who were also feeling the supply chain crunch, were trying to stock up on packaging supplies and other consumables and placing larger orders that took longer to produce and deliver.

The solution?

Staying local avoids the crunch.

In January 2022, SOTI research showed that 52% of global consumers were less likely to order an item that was shipped from overseas than they were a year ago.

"Geopolitical events increasingly influence supply chains, and the pandemic has shown us how fragile supply chains have become as a result of globalisation.' explains Artur Obolenski, Head Packaging Engineer at Packhelp.

The same SOTI report also explains that almost one in three consumers will avoid purchasing a product if delivery is more than two days.

These statistics show that consumers are unwilling to sacrifice speed and availability and are now more conscious of the supply journey.

This sentiment has all but crippled the dropshipping business model, one that thrived off low-cost goods being shipped from China to the western world.

More on the supply chain:

Byrd is a leading independent e-commerce fulfillment platform in Europe that provides scalable fulfillment services for e-commerce businesses and fast-growing D2C brands.

If there’s anyone that felt the effects of a supply chain crisis, it’s a company that provides last-mile delivery for ecommerce brands.

Augustin Martinez, marketing lead at Byrd, explains how they found solutions to the last-mile delivery crisis:

He says that the solution lay in flexibility and resilience.

“We diversified our shipping carrier network and used our tech-enabled solution to make our service more resilient. If one of our partner carriers, for example, announced that it was facing severe issues, we switched the default carrier settings for our customers so that we can remain operational’.

Diversification as a solution

Niche marketing will always be vital in getting a competitive market share. But when established brands in a niche start to struggle, what's the solution?

Diversification.

Not just of product range, but also services.

"We know now that we can't let ourselves be fully dependent on the ups and downs of the market. Unpredictability starts to be more and more present in our industry", explains Krzysztof Duszewicz, head of Packhelp Plus.

Packhelp introduced more competitive pricing and value-added services, like shorter lead times, more certified sustainable products, and expert print checks to make the company more appealing.

Customers stock up on FMCG.

The cycle of hysteria hit consumers hard when COVID first spread out of Wuhan.

Toilet paper, hand sanitiser, fresh meat, canned goods and a wide array of fast-moving consumer goods were stockpiled by consumers, unaware and staring lockdowns in the face.

But it wasn't just FMCGs that were hoarded. Many consumers also bought luxury goods in bulk, unaware of when they'll be able to get access to them again.

"The first lockdown saw a massive spike in sales, so much so we couldn't keep up", explains Rob Weatherhead at Affordable Wine.

View this post on Instagram

"Everyone was worried about the shops running out of stock or closing completely and sow as stocking up online for home delivery".

In 2021, a full 12 months after this, hysteria returned as the Delta variant started to spread. 69% of consumers said they planned to buy toilet paper, paper towels and similar items in bulk as Delta cases grew.

Inventories are beefed up.

The hoarding meant that retailers increased their inventories, putting more demand on the already weary supply chain.

Rob Weatherhead and Affordable Wines are one example of ecommerce stores stocking up on merchandise to fulfil future demand.

"We are overstocking where it is difficult to source certain lines so that we don't run out."

As a result of increased demand due to hoarding, the paper pulp industry was also affected making it increasingly important for procurement management to order supplies in advance.

"We have already started substantially increasing our stock of paper," explains Ann O'Brien from Publishing Xpress.

Samuel Belanger from Growbuds Inc says that his team that sells horticulture equipment will be stocking up 'massively'.

The resilience of the ecommerce business model

Standalone stores and online marketplaces have become commonplace and are advantageous for several reasons.

There are fewer overheads and more cost reductions for sellers, and it can be quicker and easier to start selling.

For the consumer, comparing prices is a huge benefit, and those lower overheads for the business are often passed on to the consumer.

But 2021 and the last two years have proven the resilience of the ecommerce industry.

Take Qcommerce or quick-commerce. The model sees independent couriers picking up and delivering FMCGs to your door in a half-hour or less, with consumers placing orders on an app.

Lockdowns caused this business model of online selling to explode, with players like Glovo and Deliveroo having valuations skyrocket.

Initial lockdowns saw more people staying home and looking for new things to consume themselves with.

"We saw a surge in people looking for perhaps new hobbies or improving their auto-sufficiency, which led to an increasing amount of customers.' says Samuel from Growbuds Inc.

Rob Weatherhead from Affordable Wines explains how the business all but came to him.

"We were 30% down in October and 50% up in December YOY, and we didn't do anything different."

Not all online businesses could rest on their laurels, especially those in the B2B space.

"At the first stages of the pandemic, before we strengthened our digital marketing efforts, we had a 50% decline in conversions," explains Michael Knight from Incorporation Insight.

And the resourcefulness of ecommerce business owners.

As you read earlier, retail didn't slow down as the new wave of Delta and Omicron increased infections. Consumers were committed to getting back out of the house and spending.

Online brands had to innovate or double down on tried and trust methods.

Jeff Moriarty of Tanzanite Jewelry explains how live streaming and live selling became a new sales channel for his business throughout 2021:

"Our Facebook and YoutTube live streams allowed local visitors to view our items, buy online and ask questions. The first show had over 1000+ viewers watching and generated about $10,000 in revenue," Jeff says.

"Over the next year, we started doing the shows more and more, and now it generates over $50,000 in sales each month."

While live streaming isn't new, the concept of live selling is an ecommerce trend that's set to pick up pace in the near future.

McKinsey reports that over 60% of Chinese consumers admit to having purchased something due to live selling in 2021, making the idea of live or social selling the next big thing to come out of China.

But it's important not to get too complacent or overly reliant on pre-pandemic solutions.

For example, influencer fatigue is breeding scepticism toward traditional influencer marketing from consumers and business owners alike.

'It's important that your operating costs aren't going toward outdated tools or apps that should be replaced with smarter options that even offer more features," explains Lindsay McCormick, CEO of Bite.

Email marketing is another vital channel to use in times of distress since it provides a direct channel of communication with a business’ audience. According to Andrei Marin, COO at a leading email marketing agency, CodeCrew, brands they’re servicing had yet another breakthrough year in ecommerce sales.

“We’ve seen growth as high as a 527% increase in Black Friday & Cyber Monday revenue compared to the previous year for brands like Oru Kayak.

The role of the customer increases

The customer is always right.

This adage infuriates some entrepreneurs while others swear by it. But if you're an ecommerce owner and not overly sure what the future holds, there may be a grain of truth in it.

While the customer might not always be right, they're always going to share a problem with you.

"As expected, the people needing support and assistance during Q4 increased at about 26% compared to the previous quarter," says Ian Sells of RebateKey.

Ian explains how RebateKey doubled down on keeping response time and satisfaction the same, despite the increase in queries.

"If anything, scores were fractionally higher because we streamlined processes to help with the projected influx'.

The point is this:

In an economy and business environment that's so unknown, listening to what your customer is really saying can truly pay dividends.

Gabi Sokoł, head of customer support at Packhelp, explains the process that's been created to turn customer feedback into actionable tasks.

'We've started to hold monthly meetings with key internal stakeholders called W.O.C.A.S. - What Our Customers Are Saying'.

People

"In hindsight, I would pay more attention to my own well-being and not focus as much on outside factors that I had little or no control over", says Adelle Archer from Eterneva.

The ecommerce side-hustle is a sexy idea that's not always so legitimate. With supply chains breaking down and the industry being more flooded than ever, an online store isn't a set and forget way to passive income.

The truth is that it needs a lot of dedicated hours, often from a dedicated group of people.

And when you have those dedicated people on your team, they're worth their weight in gold.

"Burnout was especially prevalent last year though we are getting back to some semblance of normality now in 2022. We've all been working odd hours and employees feeling the constant pressure of the pandemic, caring for kids, family and friends, as well as unstable working and mandate policies, increased anxiety," says Evan, C.E.O. of SportingSmiles L.L.C.

"We've given each team member a day off to fight for a better future. That might be to do charity work, attend a protest or work for a cause that's bigger than them,' Kasia Doleżał, head of H.R. at Packhelp explains.

While remote work is more prevalent now than ever, many businesses compromise with hybrid work.

However, those who have gotten used to working from home are now willing to change jobs if employers don't offer flexibility.

Conclusion

Supply chain issues, hoarding inventory due to customers hoarding goods and simply not knowing the way forward.

They're just a few of the issues that ecommerce brands felt in 2021.

While 2022 does look to be slightly different, there's no debating that we're not entirely sure what 'normal' is anymore.

Each year will bring a different marketing, a changing economy, and a customer with different needs.

Arguably, that's true for every year, but what's always going to be true is that the face and state of ecommerce is one that's ever-shifting.

If you're an ecommerce brand that's struggled with expensive packaging and long lead times, make the switch to Packhelp, and trust us to get you your packaging on time and under budget.